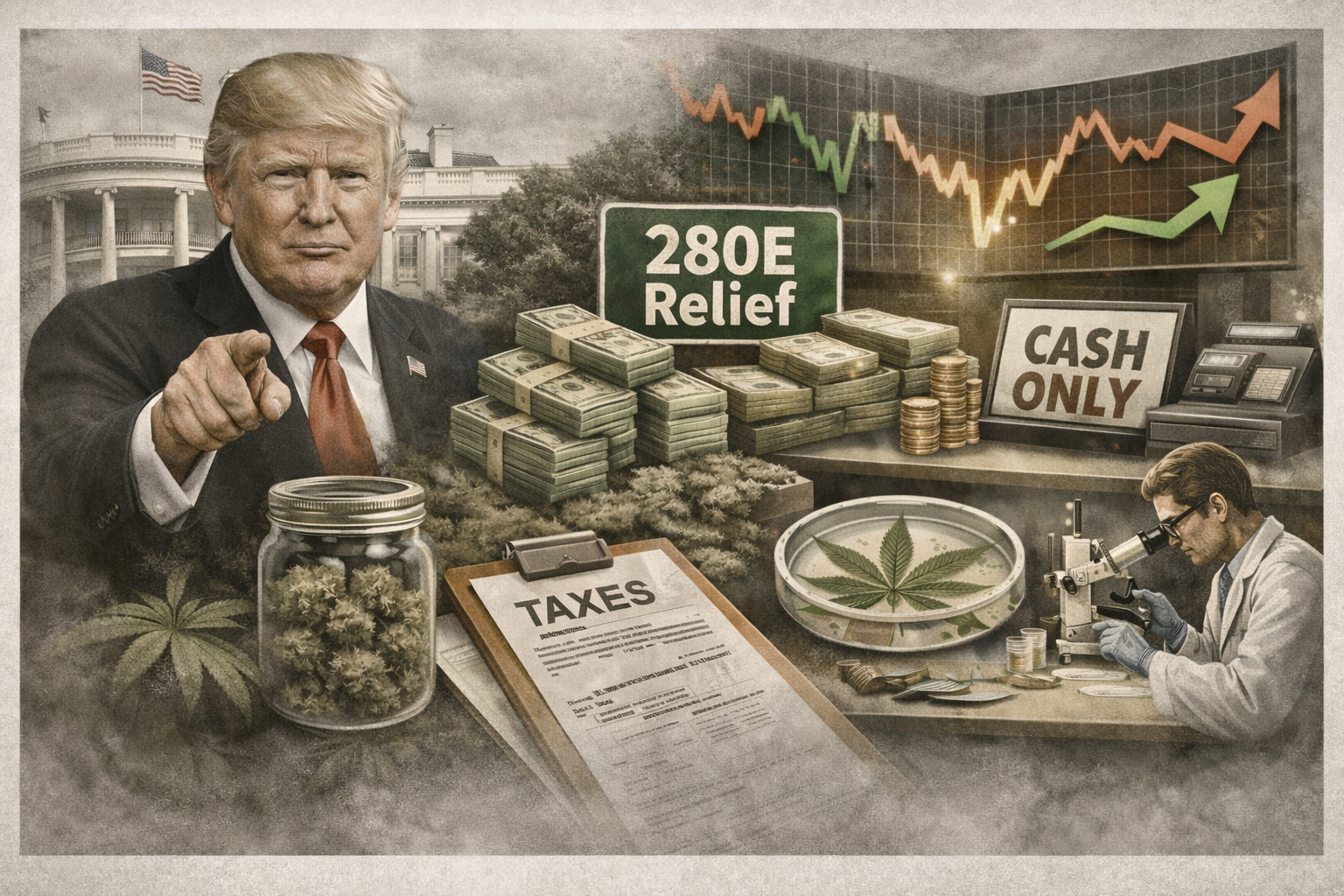

280E

Internal Revenue Code (IRC) Section 280E is a federal tax provision that prohibits businesses engaged in the "trafficking" of Schedule I or II controlled substances—which includes state-legal cannabis—from deducting otherwise ordinary and necessary business expenses. As a result, cannabis businesses are taxed on their gross income rather than their net income, often leading to effective tax rates of 70% or higher.